Apple Share Price in 2025 – Historical Trends, Performance & Forecast

Apple Inc. (NASDAQ: AAPL) is not just a tech giant; it’s a symbol of innovation, growth, and investor trust. With its strong financials and consistent product success, Apple’s stock has been a favorite among retail and institutional investors for years.

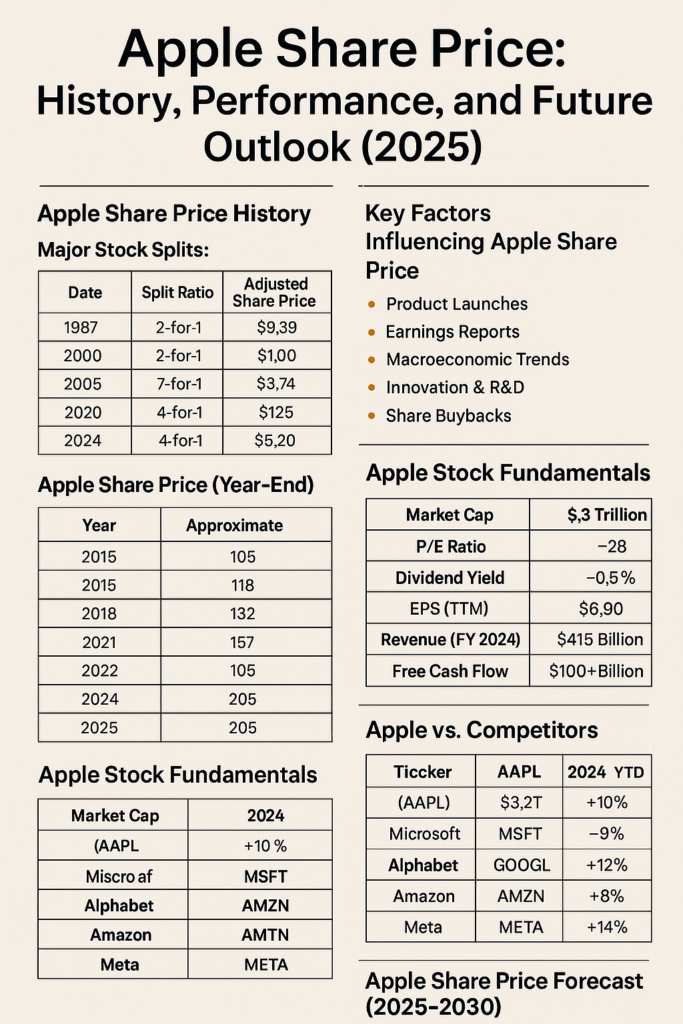

📈 Apple Share Price History

Apple Inc. went public on December 12, 1980, at a price of $22 per share. Since then, its stock has experienced multiple splits and substantial capital appreciation. Here’s a quick overview:

Major Stock Splits:

| Date | Split Ratio | Adjusted Share Price Post-Split |

|---|---|---|

| 1987-06-16 | 2-for-1 | $0.39 |

| 2000-06-21 | 2-for-1 | $1.00 |

| 2005-02-28 | 2-for-1 | $2.74 |

| 2014-06-09 | 7-for-1 | $94 |

| 2020-08-31 | 4-for-1 | $125 |

Each split significantly lowered the share price temporarily but made the stock more accessible to retail investors. After adjusting for splits, early Apple investors have seen their investments grow exponentially.

🔍 Apple Share Price Performance (2015–2024)

Apple’s share price has shown impressive growth over the last decade, with minor slowdowns during broader market corrections.

Key Milestones:

- 2015: $120 range – Steady performance amid iPhone 6S success.

- 2018: Crossed $200 for the first time.

- 2020: Reached $130 post 4-for-1 split amid strong pandemic tech demand.

- 2022: Slight correction due to global inflation and Fed rate hikes.

- 2023: Rebounded to $175–$180 levels.

- 2024: Climbed past $200 again due to Vision Pro launch and AI integration.

Apple Share Price (Year-End):

| Year | Share Price (Approx.) |

|---|---|

| 2015 | $105 |

| 2016 | $115 |

| 2017 | $170 |

| 2018 | $157 |

| 2019 | $293 |

| 2020 | $132 |

| 2021 | $177 |

| 2022 | $129 |

| 2023 | $192 |

| 2024 | $205 |

🧠 Key Factors Influencing Apple Share Price

Several factors influence AAPL’s stock performance. Let’s break down the most critical ones:

1. Product Launches

Apple’s share price often spikes around new iPhone, iPad, or Mac launches. The Vision Pro, Apple’s AR headset, created massive investor excitement in 2024.

2. Earnings Reports

Apple’s quarterly results—especially revenue from iPhones, services, and wearables—have a direct impact on its stock. Surprise earnings beat can result in double-digit price jumps.

3. Macroeconomic Trends

Interest rates, inflation, and global events like COVID-19 and chip shortages have affected Apple stock performance.

4. Innovation & R&D

Apple’s investment in AI, AR/VR, and custom silicon (M-series chips) has given it a long-term competitive edge.

5. Share Buybacks

Apple is famous for its aggressive stock repurchase program, reducing the total number of shares and increasing EPS (earnings per share).

💼 Apple Stock Fundamentals

| Metric (2024) | Value |

|---|---|

| Market Cap | $3.2 Trillion |

| P/E Ratio | ~28 |

| Dividend Yield | ~0.5% |

| EPS (TTM) | $6.90 |

| Revenue (FY 2024) | $415 Billion |

| Free Cash Flow | $100+ Billion |

Apple’s strong fundamentals ensure its stock remains a stable long-term investment.

📊 Apple vs. Competitors

Apple doesn’t operate in isolation. Here’s how it stacks up against peers:

| Company | Ticker | Market Cap | 2024 YTD Growth |

|---|---|---|---|

| Apple | AAPL | $3.2T | +10% |

| Microsoft | MSFT | $3.1T | +9% |

| Alphabet | GOOGL | $2.1T | +12% |

| Amazon | AMZN | $1.9T | +8% |

| Meta | META | $1.2T | +14% |

Apple remains a leader, often trading at a premium due to its ecosystem strength and customer loyalty.

📅 Apple Share Price Forecast (2025–2030)

Analyst Consensus for 2025:

- Bull Case: $250+

- Base Case: $220–230

- Bear Case: $190

The introduction of Apple Intelligence (AI tools integrated into iOS) and expansion in services could drive strong revenue growth through 2025 and beyond.

Long-Term Forecast:

| Year | Price Target (Estimate) |

|---|---|

| 2025 | $225 |

| 2026 | $250 |

| 2027 | $275 |

| 2028 | $300 |

| 2029 | $325 |

| 2030 | $350–400 |

These projections assume stable macroeconomic conditions and continued Apple innovation.

💡 Is Apple Stock a Good Buy in 2025?

If you’re a long-term investor, Apple remains one of the most reliable, cash-rich, and innovative companies globally. It may not offer explosive short-term returns, but it provides:

- Consistent dividends

- Aggressive buybacks

- Premium brand value

- Resilient business model

Pros:

✅ High brand loyalty

✅ Strong ecosystem (iPhone, Mac, Watch, Services)

✅ Global presence

✅ Solid financials and margins

Cons:

❌ Slower growth compared to newer tech stocks

❌ Regulatory pressure (especially in EU and China)

❌ High reliance on iPhone segment

🧾 How to Buy Apple Shares

Buying Apple shares is simple and can be done through any online brokerage platform like:

- Robinhood

- Fidelity

- E*TRADE

- Charles Schwab

- TD Ameritrade

Steps:

- Create and fund a brokerage account.

- Search for “AAPL”.

- Decide how many shares to buy.

- Place a market or limit order.

🔍 FAQs About Apple Share Price

Q1. Will Apple shares go up in 2025?

Most analysts predict continued growth, especially with AI and Vision Pro ramp-up.

Q2. Does Apple pay dividends?

Yes. Apple offers a quarterly dividend with a modest but reliable yield (~0.5%).

Q3. Is Apple stock overvalued?

While it trades at a premium, its financial strength and buybacks justify the valuation.

Q4. What happens if Apple announces another stock split?

It would lower the share price per unit but wouldn’t affect total investment value. Historically, splits result in a short-term rally.

Q5. What’s the best time to buy Apple stock?

Long-term investors can consider dollar-cost averaging, especially during market corrections or just after earnings dips.

✍️ Final Thoughts

Apple’s share price reflects a combination of technological dominance, investor trust, and strong financials. While past performance is not always indicative of future results, Apple continues to be a stronghold in many investment portfolios.

Whether you’re looking to hold for the next 5 years or just want to trade short-term movements, Apple Inc. (AAPL) remains a stock worth watching in 2025.