“Price of Suzlon Energy Share: Latest Trends, Analysis & Future Outlook in 2025”

Suzlon Energy Ltd, one of India’s leading renewable energy companies, has been in the spotlight in recent years due to its consistent growth and focus on wind energy solutions. The company has been instrumental in installing wind turbines and contributing significantly to India’s renewable energy capacity. However, just like any other stock in the stock market, Suzlon Energy’s share price has been volatile, reflecting various factors that impact its performance.

Understanding Suzlon Energy Ltd

Suzlon Energy Ltd is a renewable energy company that designs, develops, and manufactures wind turbines. With over 17,000 MW of wind power capacity installed across 18 countries, Suzlon is recognized as one of the largest wind turbine manufacturers in the world. Its operations span across India, the United States, Australia, and several other countries.

Suzlon Energy Ltd is headquartered in Pune, India. The company has seen ups and downs in terms of its stock performance, largely driven by its performance in wind power projects and shifts in government policies regarding renewable energy.

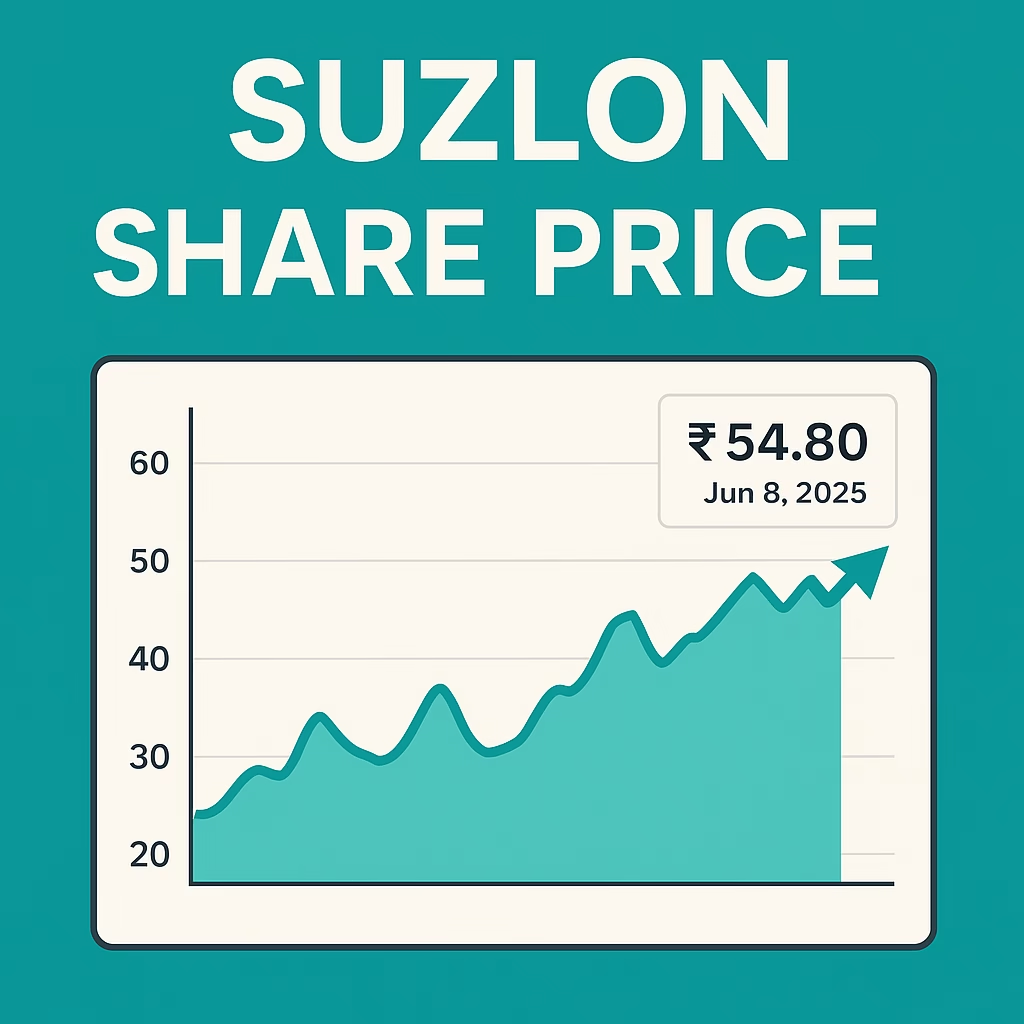

Price of Suzlon Energy Share: Current Trends

As of June 6, 2025, Suzlon Energy’s stock price is ₹66.74 on the National Stock Exchange (NSE). The stock has seen some fluctuations, as is common with companies in the renewable energy sector. Let’s break down the trends over the past few months and understand the reasons behind these fluctuations.

- Current Share Price: ₹66.74 (as of June 6, 2025)

- 52-Week High/Low: ₹86.04 / ₹46.15

- P/E Ratio: 43.89

- Market Cap: ₹91,220 crore

- Dividend Yield: 0%

- Book Value: ₹4.49

- TTM EPS: ₹1.52

Recent Stock Movement

Suzlon’s stock has witnessed both growth and volatility. Over the past month, the stock has gained about 24.28%, a significant surge considering the stock market’s volatility and changes in investor sentiment. On the other hand, over the past week, it has dipped by 6.61%. The stock’s price has been influenced by both external market conditions and Suzlon’s internal performance.

Here’s a breakdown of the key stock movements:

- Last 1 Month: +24.28% growth

- Last 1 Week: -6.61% decline

- Last 6 Months: +18.32% growth

- 52-Week Performance: Fluctuated from ₹46.15 to ₹86.04

Key Factors Influencing Suzlon Energy Share Price

Several factors influence the price of Suzlon Energy’s shares. These factors include market conditions, industry dynamics, government policies on renewable energy, and Suzlon’s financial health and project execution capabilities.

1. Market Sentiment and Renewable Energy Sector Growth

The renewable energy sector, particularly wind energy, has been gaining momentum globally. Governments are increasingly prioritizing clean and renewable energy sources to combat climate change, which has positively impacted companies like Suzlon Energy. India’s commitment to achieving a renewable energy capacity of 500 GW by 2030 plays a crucial role in boosting investor sentiment towards Suzlon.

As India moves towards cleaner energy, Suzlon is positioned well to benefit, particularly in the wind power segment, where it is one of the largest players.

2. Debt Management and Liquidity

Suzlon has had a history of high debt levels, which have raised concerns among investors in the past. However, the company has been actively working on reducing its debt burden. The recent announcement of a promoter stake sale via a block deal, aimed at raising ₹1,295 crore, is a part of the company’s strategy to reduce debt and improve liquidity.

In the long term, a reduction in debt will enhance investor confidence, potentially driving the share price upwards. However, high levels of debt remain a concern, as they can affect the company’s profitability and growth prospects.

3. Financial Performance and Profitability

Suzlon Energy’s quarterly earnings reports play a crucial role in influencing its stock price. For Q4FY25, Suzlon reported a significant increase in net profit, which surged nearly five-fold compared to the previous quarter. The company’s revenues have also been on an upward trajectory, which has been a positive signal to investors. The growth in net profit indicates that Suzlon is effectively managing its operations and capitalizing on market opportunities.

Here are some key financial figures from Q4FY25:

- Net Profit: ₹1,181 crore (a significant increase)

- Revenue Growth: Positive growth compared to previous quarters

- EPS (Earnings Per Share): ₹1.52

4. Government Policies and Incentives

Government policies are a major factor driving the renewable energy sector in India. Policies such as tax incentives, subsidies, and long-term power purchase agreements (PPAs) for wind power projects provide an attractive environment for companies like Suzlon Energy to operate in. Moreover, India’s target of achieving 500 GW of renewable energy capacity by 2030 provides a long-term growth trajectory for Suzlon and other players in the renewable energy space.

For Suzlon, government policies not only ensure long-term contracts but also reduce risks associated with projects. This provides stability to the company’s revenue streams, making its stock more attractive to investors.

Block Deal and Promoter Stake Sale

In recent news, Suzlon’s promoters, including the Tanti family and associated trusts, have announced the sale of 20 crore shares, amounting to ₹1,295 crore, in a block deal. The shares are being sold at a floor price of ₹64.75, a 2.9% discount to the current market price.

This move, while diluting the promoters’ stake, is part of the company’s debt reduction strategy. The proceeds from the sale will be used to reduce Suzlon’s debt, which is crucial for the company’s financial health.

While this deal may put downward pressure on the stock in the short term, it is ultimately a positive development as it will improve Suzlon’s balance sheet and enhance investor confidence in the company’s future prospects.

Analyst Ratings and Stock Recommendations

Analysts have mixed views on Suzlon Energy’s stock, reflecting the uncertainty surrounding the renewable energy market. However, some analysts have a positive outlook, especially due to the company’s solid position in the wind energy market.

For example, Motilal Oswal analysts have given Suzlon a ‘Buy’ rating with a target price of ₹83, representing a potential upside of approximately 16% from the current levels. They cite the company’s strong order book and expected growth in wind power installations as the key drivers of this positive outlook.

Other analysts, however, caution about the company’s debt levels and the overall volatility in the renewable energy sector. Suzlon’s stock could face short-term pressure if these concerns are not addressed effectively.

Suzlon Energy’s Global Presence and Project Pipeline

One of Suzlon Energy’s greatest strengths is its international presence. With over 17,000 MW of wind energy capacity installed globally, Suzlon is not only a leader in India but also in international markets. Its global presence helps the company diversify risk, as it is not entirely dependent on the Indian market.

The company has several large-scale projects in the pipeline, including wind farms in India, the US, and other countries. These projects will continue to drive the company’s growth and, in turn, support the stock price.

Some of the company’s key projects include:

- Jaisalmer Wind Park: Located in Rajasthan, this is one of the largest wind parks in India with an installed capacity of over 1,064 MW.

- Projects in the US: Suzlon is expanding its presence in the United States, where demand for wind energy has been steadily increasing.

These projects highlight Suzlon’s leadership in the renewable energy space and its commitment to expanding its global footprint.

Investment Considerations and Risks

Before investing in Suzlon Energy, there are several factors that investors should consider:

- Debt Levels: While the company is making efforts to reduce debt, it remains a major concern. Investors should keep an eye on Suzlon’s debt-to-equity ratio and any updates on its debt reduction plans.

- Government Policies: Changes in government policies, especially those related to renewable energy, can significantly impact Suzlon’s performance. Investors should stay updated on policy changes and their potential effects.

- Market Volatility: Like most stocks in the renewable energy sector, Suzlon Energy’s stock is subject to market fluctuations. Investors should be prepared for short-term volatility.

- Valuation: Suzlon’s current P/E ratio is relatively high compared to other companies in the renewable energy sector. Investors need to assess whether the stock’s current price justifies its growth prospects.

Conclusion

Suzlon Energy Ltd is a significant player in the renewable energy sector, particularly in wind power. With its international presence and robust project pipeline, the company is well-positioned for growth in the coming years. However, its stock price remains volatile, influenced by both internal and external factors.

The recent sale of promoter stakes, improving financial performance, and government policies supporting renewable energy all point to a positive outlook for Suzlon. However, potential investors must carefully assess the company’s debt levels, market volatility, and overall industry trends before making investment decisions.

1 thought on “Price of Suzlon Energy Share: A Detailed Analysis and Future Outlook”