Suzlon Share Price

Suzlon Energy Limited is one of India’s most prominent renewable energy companies, known for its wind energy solutions. Over the past two decades, it has transformed India’s renewable energy landscape. With growing interest in clean energy and climate-focused policies, investors are turning their eyes towards green stocks — and Suzlon remains at the forefront.

About Suzlon Energy

Suzlon Energy Ltd. is a Pune-based company founded in 1995 by Tulsi Tanti. It specializes in manufacturing wind turbines and offering end-to-end wind energy solutions. The company has installed over 19 GW of wind energy capacity across 17 countries.

Suzlon has a diversified portfolio and strong market presence in India. After going through a debt crisis in the 2010s, Suzlon restructured significantly and made a remarkable comeback — especially from 2020 onwards.

Suzlon Share Price History

Understanding the historical price trends of Suzlon stock helps investors make informed decisions.

Suzlon Share Price Movement Over the Years:

| Year | High (₹) | Low (₹) | Closing (₹) |

|---|---|---|---|

| 2010 | 97.85 | 41.50 | 45.70 |

| 2015 | 32.40 | 13.00 | 17.60 |

| 2020 | 6.50 | 2.00 | 4.15 |

| 2022 | 12.40 | 5.20 | 8.90 |

| 2023 | 44.75 | 7.25 | 39.60 |

| 2024 | 52.30 | 35.00 | 47.10 |

| 2025 YTD | 58.25 | 46.10 | 54.80 (as of June 2025) |

Note: Prices are adjusted for bonus and rights issues.

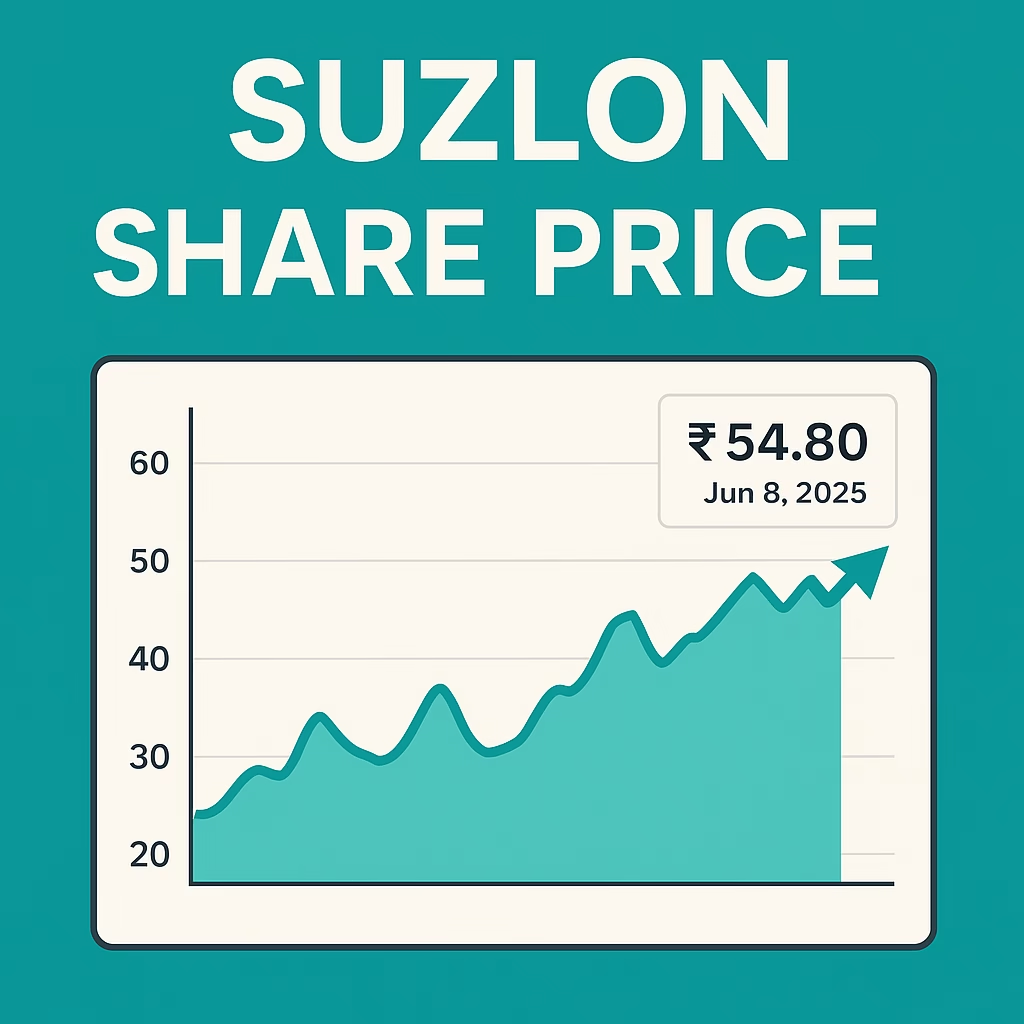

Suzlon Energy Share Price Today (Live)

As of June 8, 2025, the Suzlon share price is ₹54.80 on the NSE (National Stock Exchange), up 2.3% from the previous closing. It is trading close to its 52-week high, reflecting strong investor sentiment and robust Q4 results.

- NSE Ticker: SUZLON

- BSE Ticker: 532667

- Market Cap: ₹73,500 Crore (approx.)

- 52-Week Range: ₹35.10 – ₹58.25

Factors Influencing Suzlon Share Price in 2025

Several key drivers have influenced Suzlon’s share price rise in 2025:

1. Strong Financial Results (Q4 FY2025)

Suzlon reported solid earnings for Q4 FY2025:

- Revenue: ₹1,650 Crore (up 32% YoY)

- Net Profit: ₹320 Crore

- EBITDA Margin: 19%

- Order Book: ₹3,400 Crore

Investors welcomed these numbers as a sign of consistent recovery.

2. Debt Reduction and Financial Restructuring

Suzlon has significantly reduced its debt from over ₹13,000 Cr in 2019 to under ₹2,000 Cr in 2025. Its interest burden has reduced drastically, improving earnings per share (EPS) and net profit margins.

3. Government Push for Renewable Energy

The Indian government aims for 500 GW of non-fossil fuel capacity by 2030. Suzlon, being one of the biggest wind energy players, is a natural beneficiary.

4. FDI and Global Investor Interest

Global ESG (Environmental, Social, Governance) funds are investing heavily in green energy companies like Suzlon. FII (Foreign Institutional Investors) holdings have increased in 2024–25.

Technical Analysis of Suzlon Share Price

📈 Trend: Bullish

📊 Support Level: ₹48.00

🔼 Resistance Level: ₹58.50

🔄 Moving Averages:

- 50-Day MA: ₹50.10

- 200-Day MA: ₹43.80

Suzlon’s stock price is trading above key moving averages, indicating a strong uptrend. RSI (Relative Strength Index) is at 68, slightly below the overbought zone, suggesting room for moderate growth.

Suzlon Share Price Forecast (2025–2030)

Based on technical analysis, company performance, and industry outlook, here’s a long-term forecast of Suzlon stock price:

| Year | Expected Range (₹) |

|---|---|

| 2025 | ₹48 – ₹65 |

| 2026 | ₹60 – ₹85 |

| 2027 | ₹70 – ₹95 |

| 2028 | ₹85 – ₹120 |

| 2030 | ₹110 – ₹160 |

Disclaimer: Stock forecasts are speculative and depend on market conditions, policy changes, and company performance.

Is Suzlon a Good Investment in 2025?

✅ Reasons to Invest in Suzlon Energy:

- Turnaround Success Story: From near-bankruptcy in the 2010s to profitability in 2025.

- Renewable Energy Boom: Long-term demand driven by climate goals.

- Improving Financials: Higher revenue, lower debt, better margins.

- Experienced Management: Leadership under Tulsi Tanti’s successors remains solid.

- Strong Order Book: Healthy project pipeline with PSU and private clients.

❌ Risks to Consider:

- Global Raw Material Prices: Blade and turbine costs can fluctuate.

- Competition: From Adani Green, ReNew Power, Inox Wind.

- Execution Risk: Delays in projects can impact earnings.

- Stock Volatility: Suzlon is a high-beta stock.

Suzlon vs Other Renewable Energy Stocks (2025)

| Company | Market Cap (₹ Cr) | Share Price (₹) | 2025 YTD Return |

|---|---|---|---|

| Suzlon Energy | ₹73,500 | ₹54.80 | +28.6% |

| Adani Green Energy | ₹2,45,000 | ₹1,100+ | +12.2% |

| Inox Wind | ₹15,200 | ₹185.00 | +35.5% |

| ReNew Power | ₹29,800 | ₹580.00 | +18.7% |

Suzlon offers a low-cost entry compared to its competitors and has delivered impressive returns in the last 12–18 months.

Suzlon Share Price – Latest News (June 2025)

🔹 Suzlon Wins 450 MW Wind Energy Project

The company secured a major wind farm contract from NTPC Green Energy Ltd. The project is expected to be completed by mid-2026.

🔹 Suzlon Plans Capex of ₹1,200 Cr for FY26

Suzlon will expand its blade manufacturing and turbine assembly capacity in Gujarat and Tamil Nadu to meet rising demand.

🔹 Tulsi Tanti’s Legacy Lives On

The company continues to uphold the founder’s green energy mission. His son, Pranav Tanti, now serves in a strategic leadership role.

How to Buy Suzlon Shares?

You can invest in Suzlon shares via:

- Stockbrokers: Zerodha, Groww, Upstox, Angel One, ICICI Direct, etc.

- Demat Account: Required for buying on NSE/BSE.

- Mutual Funds/ETFs: ESG-themed funds may have Suzlon exposure.

Analyst Recommendations

| Broker/Institution | Rating | Target Price (₹) |

|---|---|---|

| Motilal Oswal | Buy | 62 |

| ICICI Direct | Strong Buy | 68 |

| HDFC Securities | Accumulate | 60 |

| Axis Capital | Hold | 56 |

FAQs About Suzlon Share Price

1. What is the Suzlon share price target for 2025?

Most analysts predict Suzlon will trade in the range of ₹50–₹65 by the end of 2025, depending on market conditions.

2. Is Suzlon debt-free?

No, but its debt levels have reduced drastically and are now manageable (~₹1,900 Cr).

3. Will Suzlon give dividends in 2025?

As of June 2025, no dividend has been announced. The company is reinvesting profits into expansion.

4. Can Suzlon reach ₹100?

If earnings momentum and policy support continue, ₹100 is possible by 2027–28.

Conclusion

Suzlon has emerged as a high-growth renewable energy stock backed by strong fundamentals, government incentives, and a green energy boom. With improved financial performance, a robust order book, and cleaner balance sheets, the stock is gaining attention from retail and institutional investors alike.

However, as with any investment, it’s important to do your own research and consider market risks before investing. Suzlon Energy share price in 2025 looks promising but should be part of a diversified portfolio.

1 thought on “Suzlon Share Price: Latest Trends, Forecast, and Investment Insights (2025)”