Axis Bank RuPay Credit Card: Benefits, Features & How to Apply

The Axis Bank RuPay Credit Card is a smart choice for anyone looking to enjoy the benefits of digital payments with seamless UPI integration, attractive rewards, and lifestyle privileges—all backed by the security and reach of Axis Bank. Whether you’re a frequent online shopper or a daily commuter, this card brings you value across every transaction.

🌟 Key Features of the Axis Bank RuPay Credit Card

✅ 1. UPI Integration

One of the standout features of this card is its compatibility with UPI apps like PhonePe, Google Pay, Paytm, and BHIM. With RuPay Credit Card on UPI, you can:

- Scan any QR code and pay directly using your credit limit

- Enjoy real-time tracking of your expenses via the app

- Eliminate the need to carry a physical card for small payments

✅ 2. Reward Points

Earn reward points on every spend:

- Get accelerated reward points on shopping, dining, fuel, and more

- Redeem points for a wide variety of options including vouchers, merchandise, and travel

✅ 3. Fuel Surcharge Waiver

Enjoy a 1% fuel surcharge waiver at all fuel stations across India for transactions between ₹400 and ₹4,000 (capped at ₹250 per month).

✅ 4. Lounge Access

Get complimentary access to domestic airport lounges across India—ideal for frequent flyers who value comfort and convenience.

✅ 5. Security & Insurance

- Zero Liability: Lost your card? Report it immediately and enjoy zero liability for fraudulent transactions.

- Personal Accident Cover: Get complimentary personal accident insurance (limits vary based on usage).

💳 Who Should Get the Axis Bank RuPay Credit Card?

This card is perfect for:

- UPI users looking to shift to credit-based QR payments

- Young professionals and salaried individuals who want to build their credit score

- Frequent travelers and shoppers who want perks like lounge access and rewards

📋 Axis Bank RuPay Credit Card Eligibility

| Criteria | Details |

| Age | 18–70 years |

| Residency | Indian residents and NRIs |

| Income Criteria | Depends on the specific variant of the card |

| Credit Score | 700+ preferred |

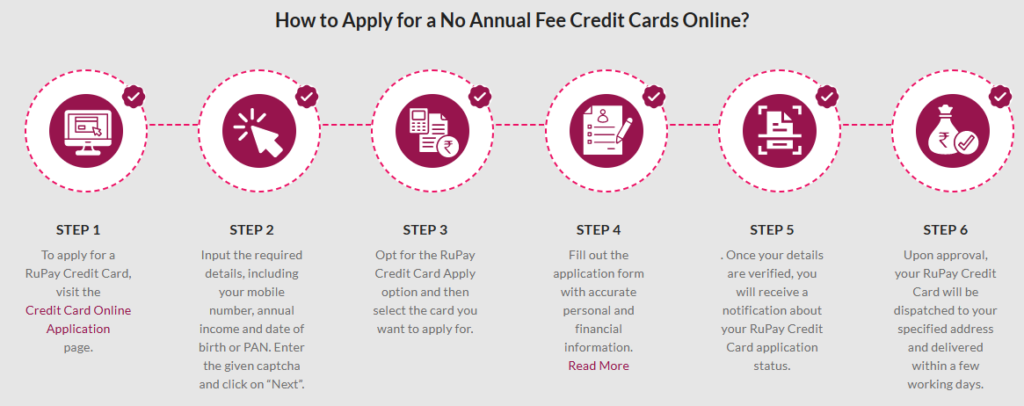

📝 How to Apply for the Axis Bank RuPay Credit Card

Applying is simple and fully digital:

- Visit the Axis Bank official credit card portal.

- Choose the RuPay credit card option.

- Fill in your personal and financial details.

- Upload required documents (ID proof, income proof, etc.).

- Wait for verification and approval status.

Alternatively, you can visit the nearest Axis Bank branch or apply via third-party financial platforms.

🧠 Final Thoughts

The Axis Bank RuPay Credit Card blends the best of UPI technology and credit card convenience. Whether you’re paying for groceries or booking flights, it offers rewards, security, and modern functionality. If you’re looking to step into the world of RuPay-powered credit, this card is a top contender.

Need help picking the right axis bank rupay credit card variant or comparing it with others? Drop a message, and I’ll help you decide based on your lifestyle and spending habits!

3 thoughts on “axis bank rupay credit card”