ICICI Prudential Bluechip Fund Equity Holdings as of 28 February 2025: Detailed List.

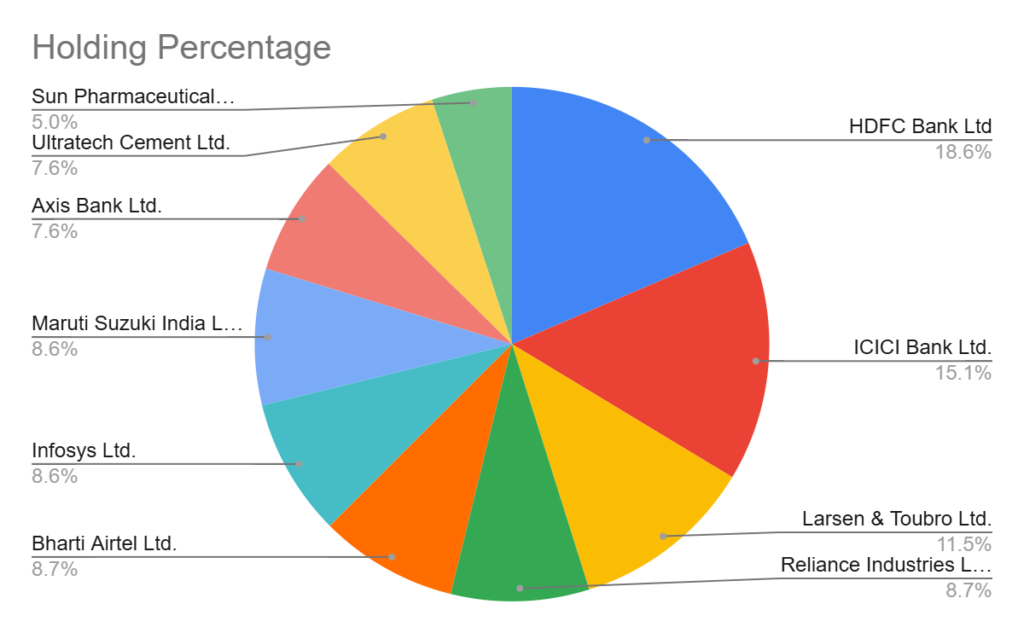

Top Equity Holdings

| Company Name | Holding Percentage |

| HDFC Bank Ltd | 9.98% |

| ICICI Bank Ltd. | 8.11% |

| Larsen & Toubro Ltd. | 6.18% |

| Reliance Industries Ltd. | 4.67% |

| Bharti Airtel Ltd. | 4.67% |

| Infosys Ltd. | 4.65% |

| Maruti Suzuki India Ltd. | 4.61% |

| Axis Bank Ltd. | 4.10% |

| Ultratech Cement Ltd. | 4.08% |

| Sun Pharmaceutical Industries Ltd. | 2.71% |

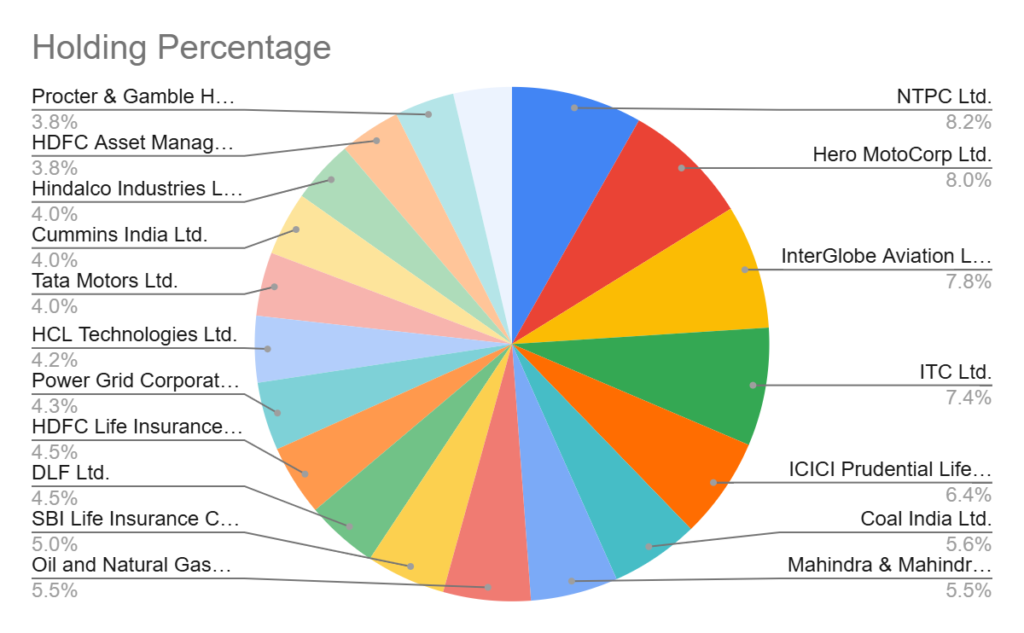

Other Major Holdings

| Company Name | Holding Percentage |

| NTPC Ltd. | 1.99% |

| Hero MotoCorp Ltd. | 1.93% |

| InterGlobe Aviation Ltd. | 1.89% |

| ITC Ltd. | 1.80% |

| ICICI Prudential Life Insurance Company Ltd. | 1.54% |

| Coal India Ltd. | 1.35% |

| Mahindra & Mahindra Ltd. | 1.33% |

| Oil and Natural Gas Corporation Ltd. | 1.33% |

| SBI Life Insurance Company Ltd. | 1.21% |

| DLF Ltd. | 1.10% |

| HDFC Life Insurance Company Ltd. | 1.08% |

| Power Grid Corporation of India Ltd. | 1.04% |

| HCL Technologies Ltd. | 1.01% |

| Tata Motors Ltd. | 0.97% |

| Cummins India Ltd. | 0.97% |

| Hindalco Industries Ltd. | 0.96% |

| HDFC Asset Management Company Ltd. | 0.93% |

| Procter & Gamble Hygiene & Health Care Ltd. | 0.91% |

| Shree Cement Ltd. | 0.89% |

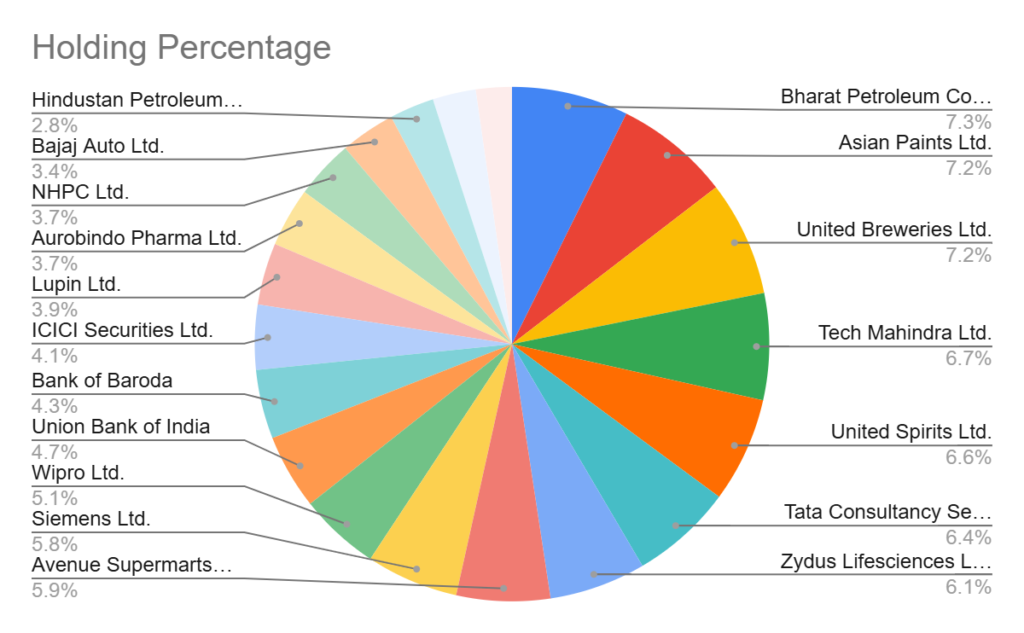

Mid to Small Holdings

| Company Name | Holding Percentage |

| Bharat Petroleum Corporation Ltd. | 0.81% |

| Asian Paints Ltd. | 0.80% |

| United Breweries Ltd. | 0.80% |

| Tech Mahindra Ltd. | 0.74% |

| United Spirits Ltd. | 0.73% |

| Tata Consultancy Services Ltd. | 0.71% |

| Zydus Lifesciences Ltd. | 0.67% |

| Avenue Supermarts Ltd. | 0.65% |

| Siemens Ltd. | 0.64% |

| Wipro Ltd. | 0.56% |

| Union Bank of India | 0.52% |

| Bank of Baroda | 0.48% |

| ICICI Securities Ltd. | 0.45% |

| Lupin Ltd. | 0.43% |

| Aurobindo Pharma Ltd. | 0.41% |

| NHPC Ltd. | 0.41% |

| Bajaj Auto Ltd. | 0.38% |

| Hindustan Petroleum Corporation Ltd. | 0.31% |

| Vedanta Limited | 0.30% |

| Muthoot Finance Ltd. | 0.25% |

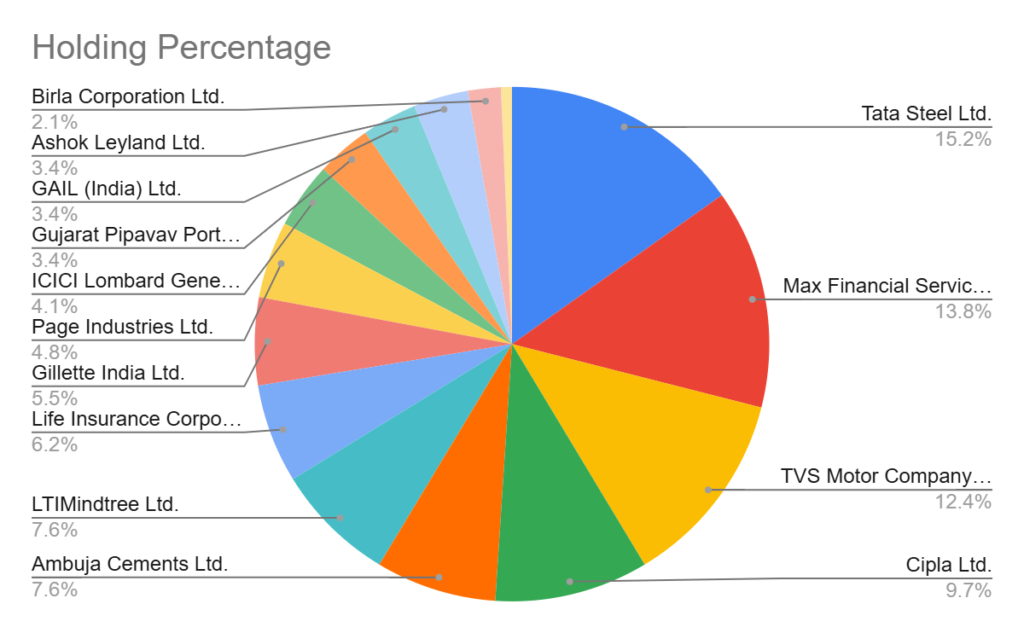

Minor Holdings

| Company Name | Holding Percentage |

| Tata Steel Ltd. | 0.22% |

| Max Financial Services Ltd. | 0.20% |

| TVS Motor Company Ltd. | 0.18% |

| Cipla Ltd. | 0.14% |

| Ambuja Cements Ltd. | 0.11% |

| LTIMindtree Ltd. | 0.11% |

| Life Insurance Corporation of India | 0.09% |

| Gillette India Ltd. | 0.08% |

| Page Industries Ltd. | 0.07% |

| ICICI Lombard General Insurance Company Ltd. | 0.06% |

| Gujarat Pipavav Port Ltd. | 0.05% |

| GAIL (India) Ltd. | 0.05% |

| Ashok Leyland Ltd. | 0.05% |

| Birla Corporation Ltd. | 0.03% |

| Syngene International Ltd. | 0.01% |

Key Highlights:

Industrial and Technology Leaders like L&T, Infosys, and Ultratech Cement also have significant weightage.

Top 3 Holdings: HDFC Bank Ltd, ICICI Bank Ltd, and Larsen & Toubro Ltd.

Banking and Financial Sector dominate the portfolio with multiple entries.

Frequently Asked Questions (FAQs)

1. What are the top 5 equity holdings as of February 28, 2025?

The top 5 holdings are HDFC Bank Ltd. (9.98%), ICICI Bank Ltd. (8.11%), Larsen & Toubro Ltd. (6.18%), Reliance Industries Ltd. (4.67%), and Bharti Airtel Ltd. (4.67%).

2. Which sector has the highest weightage in the portfolio?

The Banking and Financial sector has the highest weightage, with major holdings like HDFC Bank, ICICI Bank, and Axis Bank.

3. Is Reliance Industries a major holding in the portfolio?

Yes, Reliance Industries Ltd. holds a significant position with a 4.67% stake in the portfolio as of February 28, 2025.

4. How much percentage is allocated to Infosys Ltd.?

Infosys Ltd. has a holding of 4.65% in the portfolio.

5. Are there any insurance companies in the top holdings?

Yes, companies like ICICI Prudential Life Insurance, SBI Life Insurance, and HDFC Life Insurance are part of the equity holdings.

6. What is the holding percentage of Tata Consultancy Services (TCS)?

The holding percentage of Tata Consultancy Services (TCS) is 0.71% as of February 28, 2025.

7. Which companies have less than 1% allocation?

Some companies with less than 1% holding include Tata Motors Ltd. (0.97%), Cummins India Ltd. (0.97%), Asian Paints Ltd. (0.80%), and Tech Mahindra Ltd. (0.74%), among others.

8. What is the smallest holding in the portfolio?

The smallest holding is Syngene International Ltd. with a 0.01% allocation.