- Category: Equity – Large Cap

- Launch Date: May 5, 2008

- Asset Class: Equity

- Benchmark: NIFTY 100 TRI

- Expense Ratio: 1.41% (as on 31-03-2025)

- Status: Open-Ended Scheme

- Minimum Investment: ₹100

- Minimum Additional Investment: ₹100

- Total Assets: ₹64,962.52 Crores (as on 31-03-2025)

- Turnover: 20%

- NAV (as on 25-04-2025): ₹105.08

- 1-Day NAV Change: -1.01 (-0.96%)

- CAGR Since Inception: 14.9% (vs NIFTY 100 TRI’s 17.09%)

Investment Objective

The ICICI Prudential Bluechip Fund aims to generate long-term capital appreciation by investing in large-cap companies. The strategy is to initially invest in 20 companies selected from the top 200 NSE-listed stocks based on market capitalization. If the fund size exceeds ₹1000 crore, it gradually diversifies beyond the top 20 large-cap companies to maintain balanced growth.

Fund Management Team

- Anish Tawakley

- Vaibhav Dusad

- Sharmila D’mello

These seasoned fund managers bring their expertise in managing large-cap portfolios, focusing on quality businesses with strong balance sheets.

Performance Overview

As of April 25, 2025:

- NAV: ₹105.08

- CAGR Since Inception (May 5, 2008): 14.9%

- Benchmark CAGR (NIFTY 100 TRI): 17.09%

Despite slight underperformance compared to the benchmark, the fund has delivered steady returns over the long term, proving to be a resilient option for investors seeking stability and growth.

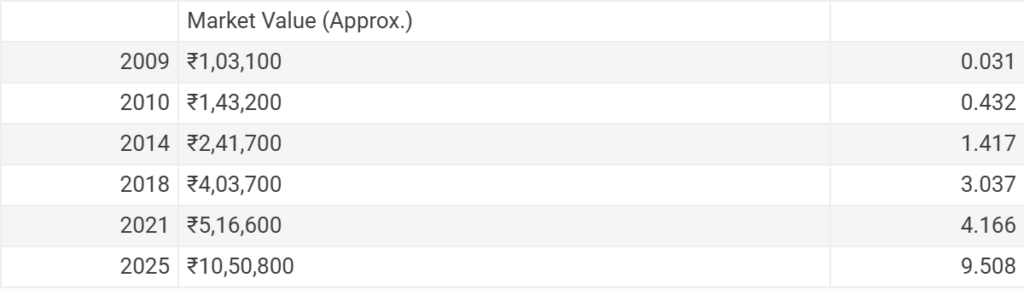

Yearly Performance Highlights

The fund has shown strong resilience through various market cycles, including the global financial crisis (2008-09) and the pandemic downturn (2020). Early investors who entered with ₹1,00,000 in May 2008 would have seen significant wealth creation over the years.

Here are some key moments:

| Year | Market Value (Approx.) | Returns (%) |

|---|---|---|

| 2009 | ₹1,03,100 | +3.1% |

| 2010 | ₹1,43,200 | +43.2% |

| 2014 | ₹2,41,700 | +141.7% |

| 2018 | ₹4,03,700 | +303.7% |

| 2021 | ₹5,16,600 | +416.6% |

| 2025 | ₹10,50,800 | +950.8% |

Why Consider ICICI Prudential Bluechip Fund?

✅ Stable Large-Cap Exposure: Investing in India’s top companies ensures lower volatility compared to mid or small caps.

✅ Proven Track Record: With a CAGR of 14.9% over 17 years, the fund has created meaningful long-term wealth.

✅ Experienced Fund Managers: A strong and stable team that focuses on value and growth opportunities.

✅ Low Turnover Ratio: 20% turnover indicates a long-term buy-and-hold strategy, minimizing transaction costs.

✅ Diversified Portfolio: While initially focused on 20 stocks, the portfolio dynamically adjusts as assets grow.

Conclusion

ICICI Prudential Bluechip Fund – Growth is an ideal choice for conservative to moderate investors looking for steady long-term returns with relatively lower risk. While it has slightly lagged behind the NIFTY 100 TRI over the long term, the fund’s stability, management quality, and focus on high-quality bluechip companies make it a strong contender in any core portfolio.

If you are seeking to build wealth steadily over time, this fund could be a smart pick for your equity allocation.

ICICI Prudential Bluechip Fund – Growth: Quick Overview (2025)

(Earlier known as ICICI Prudential Focused Bluechip Equity Fund – Growth)

Key Details

- Category: Large Cap Equity

- Launch Date: 5-May-2008

- NAV (25-Apr-2025): ₹105.08

- Expense Ratio: 1.41%

- Fund Managers: Anish Tawakley, Vaibhav Dusad, Sharmila D’mello

- Benchmark: NIFTY 100 TRI

- AUM: ₹64,962.52 crore

Why Consider This Fund?

ICICI Prudential Bluechip Fund focuses on India’s top large-cap companies, offering investors a stable and consistent growth opportunity. It has delivered 14.9% CAGR since inception, turning a ₹1 lakh investment in 2008 into ₹10.5 lakh by 2025.

The fund suits long-term investors looking for moderate risk and steady returns in volatile markets.

Quick Pros & Cons

| Pros | Cons |

|---|---|

| Strong long-term track record (14.9% CAGR) | Slight underperformance vs benchmark (NIFTY 100 TRI) |

| Focus on market leaders across sectors | Higher expense ratio (1.41%) |

| Stable portfolio with low turnover (20%) | Equity investments are inherently volatile |

| Experienced fund management team | May not suit short-term investors |

Final Word

If you’re looking to build long-term wealth through exposure to India’s biggest and strongest companies, ICICI Prudential Bluechip Fund – Growth remains a strong contender in 2025.

Growth of ₹1 Lakh Investment

| Time Period | Value of Investment | Approx. CAGR |

|---|---|---|

| 5 Years | ₹1.95 lakh | ~14.4% |

| 10 Years | ₹3.75 lakh | ~14.1% |

| 15 Years | ₹10.5 lakh | ~14.9% |

Note: Data based on NAV as of 25-Apr-2025. Past performance may not be indicative of future returns.

1 thought on “ICICI Prudential Bluechip Fund”