IDFC RuPay Credit Card: Benefits, Features & Why It’s a Smart Choice for Indians

As India transitions toward a cashless economy, the IDFC RuPay Credit Card emerges as a powerful financial tool—combining the efficiency of IDFC FIRST Bank with the indigenous technology of the RuPay network. This card is specially crafted for users who want the flexibility of UPI payments, domestic transaction reliability, and rewarding benefits—all rolled into one.

What is the IDFC RuPay Credit Card?

The IDFC RuPay Credit Card is a credit card issued by IDFC FIRST Bank, running on the RuPay network, developed by the National Payments Corporation of India (NPCI). It supports UPI-based transactions, reward programs, and provides enhanced affordability through zero joining fees and lifetime free access—depending on the variant.

Key Features of IDFC RuPay Credit Card

✅ UPI Integration

Link your RuPay credit card with popular UPI apps like Google Pay, PhonePe, BHIM, and Paytm to make seamless payments through UPI using your credit line.

✅ Zero Joining & Annual Fee (Select Variants)

IDFC is known for offering lifetime free cards—no hidden charges, no annual renewal fees.

✅ Interest-Free Period of Up to 48 Days

Enjoy longer interest-free durations, giving you more flexibility in managing finances.

✅ Dynamic Interest Rates

IDFC offers competitive interest rates starting from 0.75% to 3.5% per month based on your profile and card usage.

✅ 10X Reward Points

Earn up to 10X reward points on online purchases, dining, travel, and more.

✅ Contactless Payments

Tap and pay for instant transactions at supported POS machines.

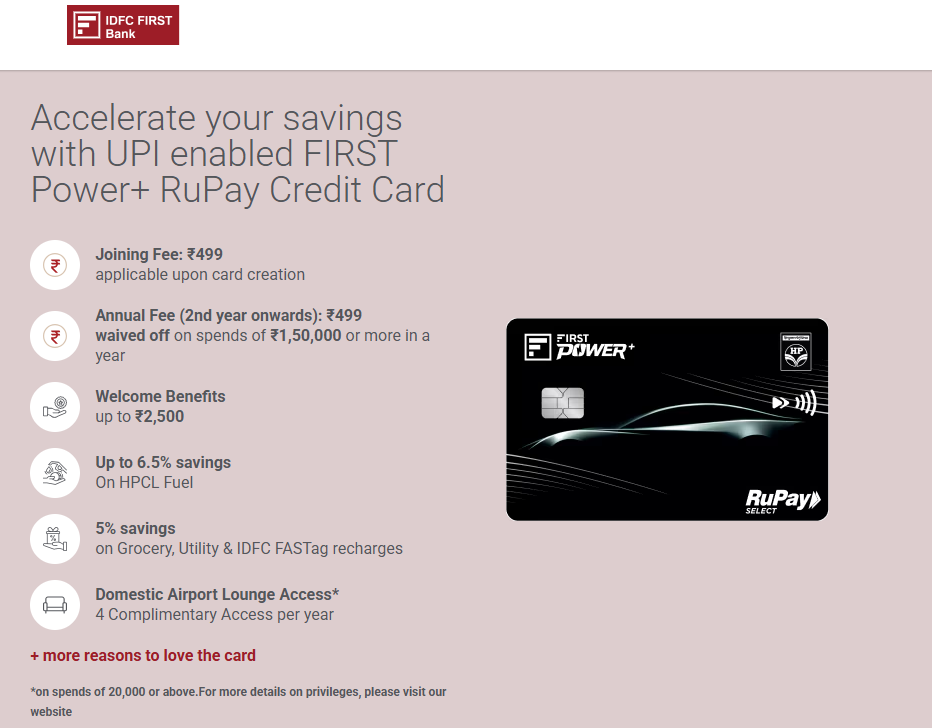

✅ Welcome Benefits

Get free vouchers, cashback, and discounts on your first few transactions depending on the current offer.

Types of IDFC RuPay Credit Cards

| Card Variant | Key Highlights |

| IDFC FIRST Classic RuPay | Lifetime free, good for beginners, UPI enabled |

| IDFC FIRST Select RuPay | High reward rate, airport lounge access |

| IDFC FIRST Wealth RuPay | Premium features, golf benefits, concierge |

| IDFC FIRST Millennia RuPay | Designed for digital-savvy users with cashback & rewards |

Benefits of Choosing RuPay over Visa/Mastercard

- Indigenous & Cost-Effective

Being Indian-made, transaction processing is more affordable for merchants. - Faster UPI Credit Card Payments

Unlike Visa or Mastercard, only RuPay credit cards are allowed on UPI (as per current RBI guidelines). - Better Integration with Govt Schemes

Useful for linking with government benefits, subsidies, and DBT. - High Security

RuPay processes most data within India, minimizing external risks.

Charges & Fees (Typical Range)

| Fee Type | Amount |

| Joining Fee | ₹0 – ₹500 (often waived) |

| Annual Fee | ₹0 – ₹500 |

| Interest Rate | 0.75% to 3.5% p.m. |

| Late Payment Charges | ₹100 – ₹1,000 |

| Foreign Markup | ~1.99% – 3.5% |

How to Apply for the IDFC RuPay Credit Card

🖥️ Online

- Visit IDFC FIRST Bank’s credit card portal.

- Select the desired RuPay card variant.

- Fill in your PAN, mobile, and employment details.

- Complete video KYC and wait for approval.

🏦 Offline

- Visit any IDFC FIRST Bank branch.

- Submit documents including ID proof, PAN, and income documents.

- Complete verification and receive the card by post.

Final Thoughts

If you’re looking for a modern credit card with UPI functionality, no hidden fees, and powerful reward features, the IDFC RuPay Credit Card is a strong contender. It caters to both first-time cardholders and savvy spenders looking for flexibility, security, and value.

Frequently Asked Questions (FAQs)

Q1. Can I use IDFC RuPay Credit Card on UPI?

Yes, you can link it to Google Pay, PhonePe, Paytm, and more.

Q2. Is IDFC RuPay Credit Card lifetime free?

Yes, most variants are lifetime free, but always check the latest offer.

Q3. Can I convert purchases to EMI?

Yes, IDFC allows easy EMI conversions on eligible transactions.

1 thought on “Idfc Rupay Credit Card”